Update tax rates

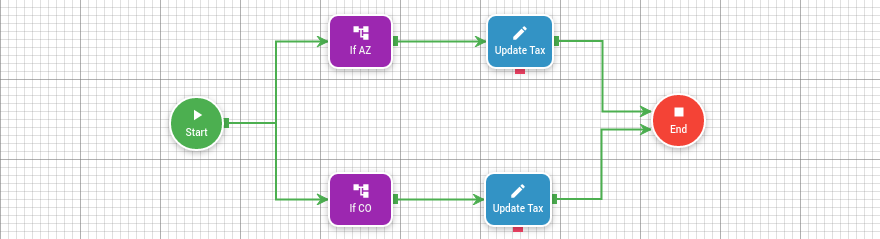

Update tax rates sample flow.

Summary

In this example, we demonstrate an action that dynamically updates the tax rate percentage based on the customer’s location. When the customer’s location is Colorado, the tax rate is set to 5%, while for customers in Arizona, the tax rate is adjusted to 6.5%. This showcases how you can use contextual information to make real-time adjustments and tailor processes to specific conditions.

Step: start

Inputs

No configuration required.

Outputs

No configuration required.

Context

- record: Record

- oldRecord: Record

- action: Action

- oldRecord: Record

- action: Action

Step: If CO

Inputs

| Label | Type | Value |

|---|---|---|

| Condition | Condition | record.field(‘customer.address.state’).val() === ‘CO’ |

Outputs

No configuration required.

Context

- record: Record

- oldRecord: Record

- action: Action

- oldRecord: Record

- action: Action

Step: If AZ

Inputs

| Label | Type | Value |

|---|---|---|

| Condition | Condition | record.field(‘customer.address.state’).val() === ‘AZ’ |

Outputs

No configuration required.

Context

- record: Record

- oldRecord: Record

- action: Action

- oldRecord: Record

- action: Action

Step: Update tax rate Colorado

Inputs

| Label | Type | Value |

|---|---|---|

| Record | record | context.record |

| Tax Rates | percentage | 0.05 |

Outputs

| Label | Type | Description |

|---|---|---|

| updatedRecord | record | put in context == false |

Context

- record: Record

- oldRecord: Record

- action: Action

- oldRecord: Record

- action: Action

Step: Update tax rate Arizona

Inputs

| Label | Type | Value |

|---|---|---|

| Record | record | context.record |

| Tax Rates | percentage | 0.05 |

Outputs

| Label | Type | Description |

|---|---|---|

| updatedRecord | record | put in context == false |

Context

- record: Record

- oldRecord: Record

- action: Action

- oldRecord: Record

- action: Action

Step: end

Inputs

| Label | Type | Description |

|---|---|---|

| Return result | boolean | If true it will return the final result of the flow. |

Outputs

No configuration required.

Context

- record: Record

- oldRecord: Record

- action: Action

- oldRecord: Record

- action: Action